XNXubd VPN Browser APK Download 2024

XNXubd VPN browser APK offers a great combination of a VPN (Virtual private network) and a web browser providing users with awesome features like no geographical barriers, encrypted internet connections, and anonymous browsing.

The goal of the xnxubd VPN browser is the privacy protection, faster internet speed and online safety of the users. If you prioritize online security, then you should use our browser to browse the internet privately and avoid cyber-attacks, hackers and data breaches. Xnxubd VPN hides your IP address to keep you safe and secure while browsing the internet. This is indeed a great browser. Many people are praising this.

About Xnxubd VPN Browser APK

In today’s digital world, everyone uses the internet daily. Keeping this in mind, the online safety and security is more important than ever. XNXubd VPN browser APK anti blokir untuk Android is a great solution for concerns like these. Now you can browse any of your favorite websites with confidence without worrying about your identity.

The XNXubd VPN browser hides your IP address and allows you to unlock all websites. It helps you browse anonymously and encrypts your internet connection for greater online safety.

Key Features

The key features of XNXubd VPN browser APK include:

Download Xnxubd VPN Browser APK

You can easily download XNXubd VPN browser APK terbaru 2024 from the below links for both Android and iOS.

Additional Information

| App Name | XNXubd VPN Browser APK |

|---|---|

| Latest Version | 3.0.0 |

| Size | 17MB |

| Requires | Android 5.0+ |

| Total Downloads | 87582+ |

| Updated | Today |

Features of XNXUBD VPN Browser APK

Let’s have a look at the unmatched features of the XNXubd that made this browser very popular among the users.

Enhanced Online Security

Online security is of utmost importance when it comes to internet browsing. XNXubd VPN adds an extra layer of security while you browse the internet by encrypting your internet connection. This encryption keeps you safe from hackers, and identity thieves especially if you are using a public Wi-Fi network.

Anonymous Browsing and Privacy Protection

One of the great features of XNXubd VPN browser APK is that it hides your real IP address and assigns you a virtual IP address from a different server. It helps you browse the internet anonymously without worrying about your identity and it also helps you avoid data collection by any websites, advertisers or any other third part tool.

No Geographical Restrictions

Some streaming services are only country specific and some news websites and other websites block the access from a specific country. Or your country may also have blocked the access to certain websites. In these cases, XNXUBD APK VPN can help you access the restricted content by connecting to a country specific server or any server outside of your country.

No Bandwidth Throttling

Internet service providers (ISP) intentionally slow down the streaming and torrenting. You can avoid this and enjoy unlimited bandwidth with the help of XNXubd VPN browser APK anti blokir untuk Android download as it bypasses your ISP restrictions.

Public Networks Privacy

XNXubd VPN browser can also keep you safe while using the public Wi-Fi networks including internet cafes, hotels and airports’ Wi-Fi. These public Wi-Fi networks are unsecure and are easy targets of hackers. XNXUBD VPN allows you to use these networks without worrying about data breaches and hacking attempts.

High-Speed and Reliable Connectivity

Our XNXubd VPN browser has a network of servers that are strategically located to ensure faster speeds and stable connections. When you connect to any VPN, it slows down the browsing speed. But, XNXUBD VPN has come up with the solution to this problem by providing users with smooth browsing and minimal latency thanks to the strategically placed servers.

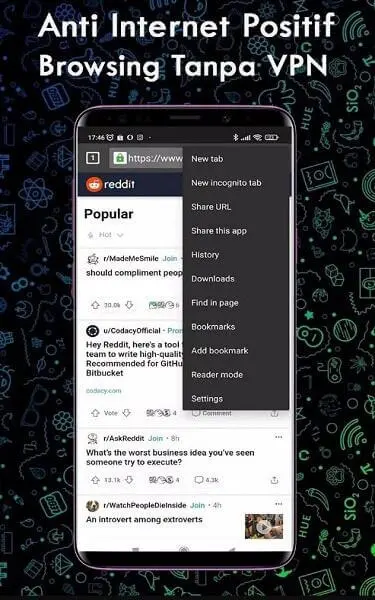

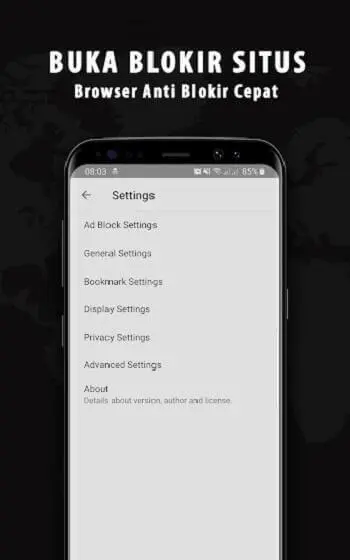

User Friendly Interface

The XNXUBD VPN browser has a user friendly interface that is easy to explore for newbies as well as experienced users. You can easily connect to a VPN by tapping on your preferred server location to enjoy a secure browsing. Simple and modern UI of XNXUBD will definitely make your experience enjoyable.

Reliable Encrypted Connections

The XNXUBD APK VPN Browser provides an end to end encryption feature eliminating the possibility of any lope holes that can assist hackers. This is of great importance when you have important passwords, and you use banking apps on your mobile phone. XNXubd will secure your passwords and financial information from cybercriminals.

Many Servers

XNXUBD VPN APK has a network of high quality servers located in different regions of the world. Unless you want to access the country specific content, it is recommended that you should connect to your nearest server to minimize latency and get faster internet speeds.

Browse Restricted Content with Anti Blocking VPN

Xnxubd VPN browser can help you unblock restricted websites effortlessly. Anti-blocking VPN feature of xnxubd browser will allow you to get access to restricted content without the need to install any extra VPN.

Tips for Using XNXUBD VPN Browser

Here are some tips for taking the maximum benefit from XNXubd VPN:

How to Download XNXubd VPN Browser APK?

Follow the steps below to download XNXUBD VPN:

- First, visit our website https://xnxubdvpnbrowserapk.net/ and scroll down to find the download button

- Click the download button and it’ll redirect you to the download page

- On the download page, you can download XNXubd VPN browser for android or for iOS depending on your mobile phone’s operating system

- To download, click the download button on the download page and the download will start in no time

- We recommend a faster internet connection to download xnxubd

- Wait for the download to complete and then install XNXubd VPN

How to Install XNXubd VPN Browser APK?

To install XNXUBD on your smartphone, follow the steps below:

- Locate the downloaded file in the downloads manager or file manager

- Before installing the XNXubd APK, you must enable unknown sources installation. To do this, go to your mobile phone’s settings, then go to security and privacy and turn on unknown sources installation.

- After locating the file, tap on the XNXUBD VPN APK

- Then, tap the install and allow any permissions

- Installation will take a few moments

- After the installation is complete, open the XNXubd VPN

- When opening this VPN browser for the first time, it will ask you to do the initial setup

- To setup XNXUBD, follow the on screen instructions

- Voila! You just installed the XNXubd VPN browser and now you can use it to browse the internet anonymously

Conclusion

XNXUBD VPN browser APK is a perfect tool for online safety and privacy protection. Its feature like anonymous browsing, encrypted connections and bypassing geographical barriers make it a go to browser for users who prioritize online security.

Read the tips provided in our guide to take the maximum benefit from Xnxubd VPN and browse the internet with confidence.